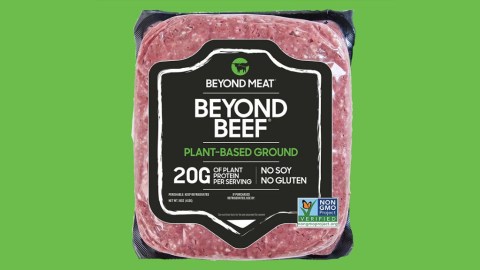

Beyond Meat announces plan to sell ‘ground beef’ in stores. Shares skyrocket.

- Shares of Beyond Meat opened at around $200 on Tuesday morning, falling to nearly $170 by the afternoon.

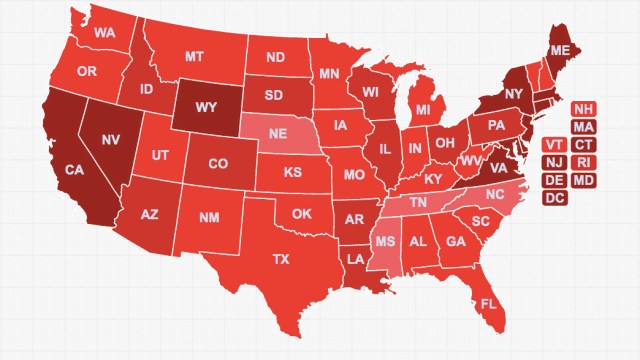

- Wall Street analysts remain wary of the stock, which has been on a massive hot streak since its IPO in May.

- Beyond Meat faces competition from Impossible Foods and, as of this week, Tyson.

Shares of Beyond Meat soared Tuesday after the company announced plans to sell a ground-beef product called ‘Beyond Beef’ in grocery stores nationwide.

On Tuesday morning, Beyond Meat (BYND) opened at about $200, but by the afternoon fell to $170. The drop was partly fueled by Wall Street analysts saying the company is overvalued. (For context, the highest price target among analysts is currently $123.) Still, Beyond Meat is trading far above its initial public offering price of $25, and analysts seem generally optimistic about the company over the long term.

“Despite the valuation considerations, we continue to expect significant growth potential in the plant-based meat category and believe that Beyond Meat is well positioned as one of the frontrunners leading the new wave of plant-based meat products,” said Bernstein, the Wall Street research and brokerage firm.

“Come be among the first to try this delicious new product that delivers the versatility, meaty texture and juiciness of ground beef with less of the baggage!” the company wrote in an Instagram post.

Beyond Meat says its new product is “versatile enough to use in any ground beef recipe,” and that it will tenderize and marbelize just like real meat. Last week, the company debuted a new burger patty that contains cocoa butter and coconut oil, which create a marbling effect when cooked. Beyond Meat CEO Ethan Brown told CNN Business his company will probably continue to issue new products and improve upon existing ones.

“It’s part of our philosophy and our approach to innovation that we’re going to be constantly iterating,” he said.

Brown echoed similar thoughts on a call with analysts following Beyond Meat’s first-quarter earnings results.

“I am maniacally focused on driving this business forward through innovation,” he said. “I have no distraction with an incumbent business, no concerns about upsetting my existing supply chain.”

The alternative meat war

But Impossible Foods – Beyond Meat’s chief competitor – is also vying to dominate the alternative meat industry.

“They’ve both publicly stated that their goal is to really reach every single person,” Zak Weston, a food service analyst at the Good Food Institute, told Marketplace.

What’s more, Impossible Foods might be more popular.

“Based on our search volume data, it is clear that the Impossible Burger is much more popular among consumers than the Beyond Meat burger,” Olga Andrienko, head of global marketing at SEMrush, told MarketWatch. “While search volume cannot determine causation, the significant difference in consumer interest for one of its main competitors, the Impossible Burger, points to a larger long-term risk for Beyond Meat in addition to its recent losses on Wall Street.”

Tyson – the world’s second largest meat processor – also debuted new alternative meat products this week under the Raised & Rooted brand. Ultimately, the winner of the alternative meat war will likely come down to which company can better mimic the taste, texture and appearance of real meat. After all, these companies aren’t advertising primarily to vegans or vegetarians – they’re going after carnivores.