It could be worse: 5 countries have triple-digit inflation

- For the first time in decades, the inflation genie is out of the bottle.

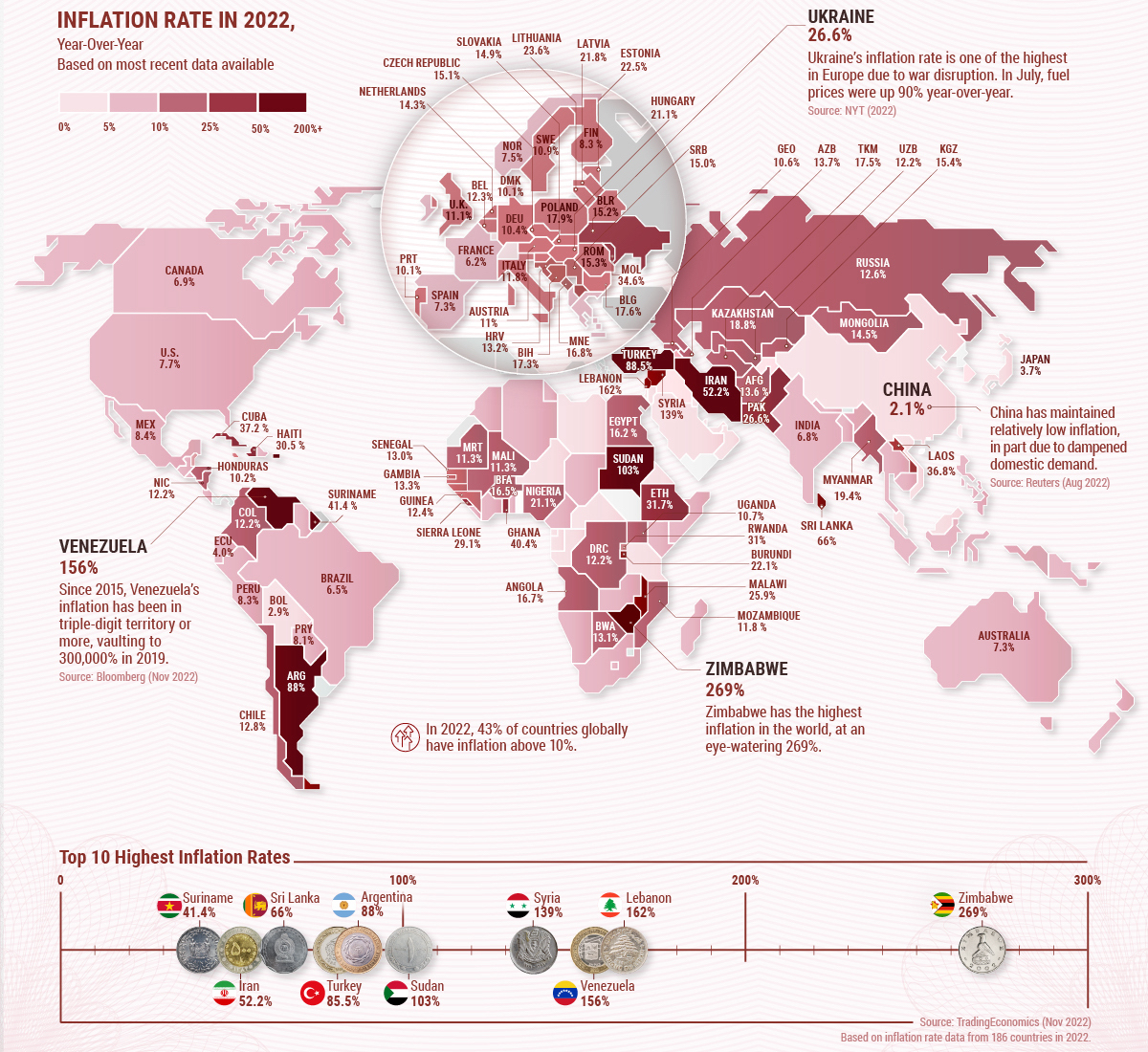

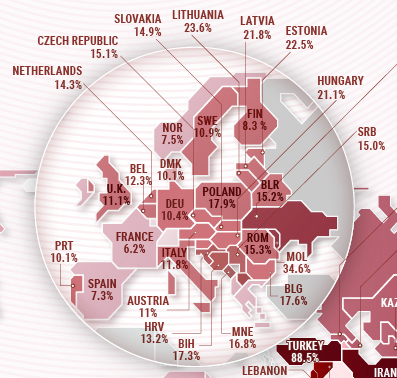

- As this map shows, many countries struggle with double-digit inflation.

- It could always be worse — unless you’re in Zimbabwe, the inflation world champion.

The UK currently has a National Living Wage that works out to around £20,000 ($24,500) per year. Yet Mr. Darcy, Elizabeth Bennett’s love interest in Pride and Prejudice, is considered fabulously wealthy with an annual income of just half that amount.

A swoonable amount

“Dear me! Mr. Darcy! Who would have thought it!” swoons Elizabeth’s mother in chapter 59, when she finds out about her daughter’s romance. “Oh! My sweetest Lizzy! How rich and how great you will be! What pin-money, what jewels, what carriages you will have!… A house in town! Everything that is charming!… Ten thousand a year, and very likely more! ‘Tis as good as a Lord!”

The book is set in 1811, but the monetary difference between then and now is not so much about time as it is about two centuries’ worth of inflation. Translated into today’s money, Mr. Darcy’s annual income would be about £550,000 ($670,000) — still a swoonable amount, even considering the current rate at which money is devaluing.

Inflation is a curious thing. Most economists agree we should have a little, as it greases the wheels of the economy — but not more than about 2%. Anything above that, inflation erodes buying power, consumer confidence, corporate competitiveness, and entire economies.

(Just in case you’re wondering, deflation — the opposite of inflation, when your money today buys you more than it did last week — comes with its own set of mind-boggling problems. Generally, deflation is considered far worse than inflation.)

Inflation genie out of the bottle

For the past few decades, most of the world’s mature economies have kept the inflation genie locked safely away. You have to go back to the 1970s and early 1980s for double-digit inflation in North America or Western Europe. But today, the inflation genie is out of the bottle for a variety of reasons: Supply chain issues, shortages, pent up demand from the COVID pandemic, and government stimulus all play a role.

This map, giving the latest available figures per country, demonstrates the global extent of the crisis. In all, 73 countries around the world — that’s more than four in ten — are currently experiencing double-digit inflation.

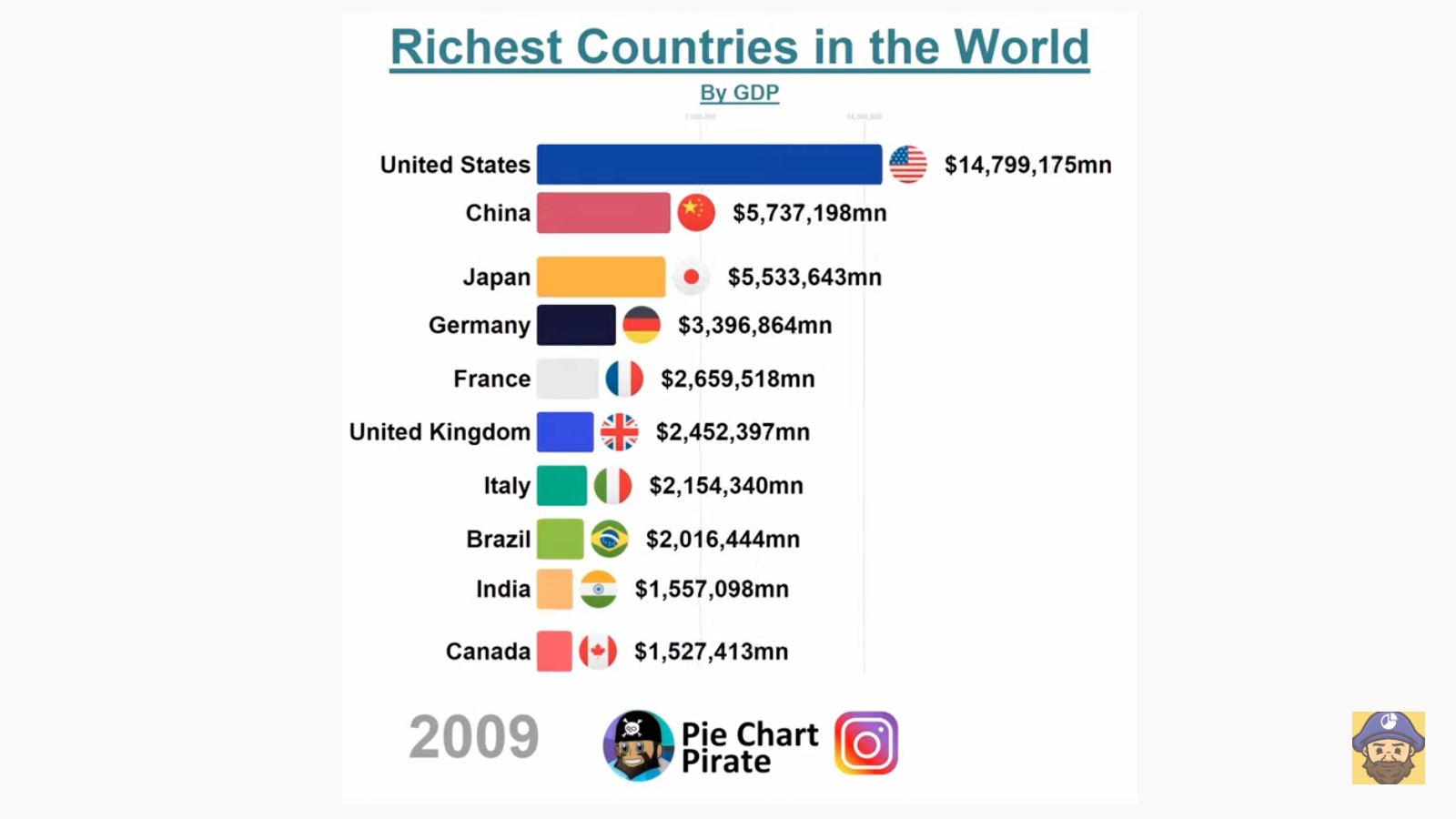

But five countries have it even worse. They’re struggling with triple-digit inflation. They are Zimbabwe (269%, the highest inflation rate in the world), Lebanon (162%), Venezuela (156%), Syria (139%), and Sudan (103%). The next five — the highest double-digiters — are an equally diverse bunch, geographically speaking: Argentina (88%), Turkey (85.5%), Sri Lanka (66%), Iran (52.2%), and Suriname (41.4%).

Inflation rates this high are not just the result of the world’s recent economic troubles. Typically, they are the symptom of large-scale and long-term economic mismanagement, which the recent crisis has only served to exacerbate. (Syria at least can blame its economic woes on its seemingly unending civil war.)

The next batch of ten countries sees the first two in North America — Cuba (37.2%) in 12th place and Haiti (30.5%) in 17th — and the first two in Europe — Moldova (34.6%) in 14th place and Ukraine (26.6%) in 20th. Haiti and Moldova’s bad scores aren’t surprising; each is the poorest country of its respective continent. Communist Cuba’s woes can be traced back to the ineptitude of its command economy and/or the crippling effect of the U.S. economic blockade. (To be fair, it’s probably a bit of both.) Ukraine, currently fighting for its survival against Russia, is worried about deadlier things coming after its citizens.

Afghanistan outperforming the Netherlands

Nigeria, Africa’s biggest economy, is suffering 21.2% inflation, while Egypt, the continent’s second-largest economy, is living with 16.2% — which means that large sections of these very populous nations are slipping into poverty.

All things considered, Afghanistan (13.6%) is doing relatively well, at least according to this metric. It’s better than the Netherlands (14.3%), for instance. And considering the attempts to bring economic pressure on Putin for his invasion of Ukraine, Russia (12.6%) isn’t doing too badly either, which is roughly in the same league as Belgium (12.3%).

Three out of Western Europe’s Big Five economies are in double-digit territory: Italy (11.8%), the UK (11.1%), and Germany (10.4%). Spain (7.3%) and France (6.2%) are managing quite a bit better. Certainly playing to France’s advantage is the fact that, unlike import-dependent Germany, it can largely rely on its homegrown nuclear industry for energy.

Inflation isn’t everything

The inflation in North America’s three biggest economies is higher than the ideal, but not quite yet in double-digit territory. Mexico’s (8.4%) is the highest, Canada’s (6.9%) the lowest, with the U.S. (7.7%) neatly in between.

While many African countries struggle with inflation, there are also plenty who manage to stay close to the magic 2%, including Equatorial Guinea (2.9%), the Central African Republic (2.7%), and Benin (2.1%).

Of the major economies, Japan (3.7%) is near the top of the class. The biggest standout is China (2.1%), with a near-perfect score. However, as recent protests in that country have made clear, people don’t live on inflation rates alone.

The most remarkable score is South Sudan’s (-2.5%). It is the only country that is experiencing negative inflation — a.k.a. the aforementioned deflation. Sudan, its neighbor to the north, is suffering from 103% inflation. That must make for some interesting cross-border trade — in pin-money, jewels, and carriages, and probably a whole lot more.

Strange Maps #1183

Map from Visual Capitalist. Source and article here.

Got a strange map? Let me know at strangemaps@gmail.com.

Follow Strange Maps on Twitter and Facebook.