The Wizard of Oz is a story about the dangers of the gold standard

- The Wizard of Oz film was based on a 1900 novel written by L. Frank Baum, who some believe intended the story to be an allegory about the gold standard.

- The gold standard tied the value of national currency to gold, enabling people to convert paper money into a fixed amount of gold.

- When viewed as an allegory, it becomes easy to see overlaps between the main players in The Wizard of Oz and different groups of early-20th-century Americans.

The Wizard of Oz is a beloved, award-winning film that spun into a cultural phenomenon, but did you know that there’s a secret meaning behind Dorothy’s adventure? Some historians and economists believe that the tale represents how America navigated the gold standard.

From the Yellow Brick Road to the Emerald City, each character and circumstance we encounter represents a different faction of the U.S. during the late 19th and early 20th century, according to the theory. When viewed through this lens, The Wizard of Oz is a multilayered story that touches on the political and social tensions of the time.

Setting the stage

The Wizard of Oz film was actually based on an L. Frank Baum novel, which was published in 1900 amid political tension in the U.S. Previously, the Coinage Act of 1873 had effectively stomped out the policy of bimetallism in the U.S. As a result, if you held silver bullion, you could no longer use it to make U.S. coins. This was followed by an economic depression and a rallying cry from many Americans to bring back bimetallism.

Many see The Wizard of Oz as a thinly veiled allegory of the “gold bugs” versus “silverites.” To provide some context, the last quarter of the 19th century saw a boom in industrialism, mostly in the Northeast. Other areas of the country were still mostly reliant on agriculture. The 1896 presidential election bred the rise of gold bugs, who supported the gold standard.

According to historian Alan Gevinson, these folks felt that the gold standard was the best way to keep the dollar stable, maintain a competitive marketplace, and promote economic liberty. Silverites, on the other hand, felt that currency should be redeemable in both gold and silver. Since silver was more easily accessible, the idea was that “free silver” could create a more flexible money supply. This, they hoped, would lead to a fairer economy and much-needed social reforms.

Most farmers were in the silverite camp. When the minting of silver coins was discontinued in 1873, it effectively tightened the money supply — which benefited banks and other creditors. Farmers, meanwhile, were perpetually indebted to creditors.

Things came to a fever pitch during the 1896 presidential election. The democratic nominee, William Jennings Bryan, was a vocal opponent of the gold standard and the voice of the pro-silver movement. The Republican candidate, Governor William McKinley, rallied support from many urban industrial workers by suggesting that a Bryan victory would lead to increased unemployment and lower wages. Bryan ultimately lost to McKinley, who went on to sign the Gold Standard Act in 1900.

Understanding the context of the gold standard

The gold standard tied the value of a national currency to gold. Under this system, paper money could be converted into a fixed amount of gold.

While it’s no longer used by governments today, the gold standard had its moment from 1871 to 1914. By the early 20th century, most developed countries adhered to it. That included the United States, which formally adopted the gold standard in 1900 when Congress passed the Gold Standard Act. This was also the year that Baum published The Wizard of Oz.

The gold standard came with certain benefits. For one, it helped curb inflation because banks and governments had little influence, if any, over a nation’s money supply. That runs counter to the way things are done today. But the gold standard also had its drawbacks. Gold proved itself to be less flexible in the face of challenging economic conditions — a reality that took center stage during World War I. The Great War sent European financial systems into a tailspin. As a result, the U.S. dollar became a more prominent global currency as many nations abandoned the gold standard to navigate massive military expenditures.

The gold standard gradually deteriorated over the following decades. In the early 1930s, Americans were required to convert all gold coins, certificates, and bullions into U.S. dollars. The dollar officially uncoupled from gold altogether in 1976, signaling the end of the gold standard in the U.S.

Unraveling the hidden meanings behind The Wizard of Oz

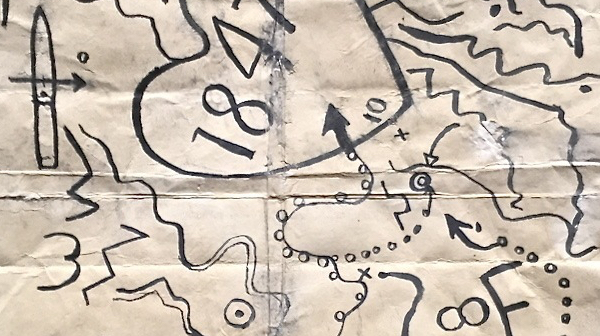

When viewed as an allegory, the main players in The Wizard of Oz correspond to these groups:

- Dorothy: The average American

- The Scarecrow: Farmers

- The Tin Man: Industrial workers

- The Cowardly Lion: William Jennings Bryan

- The Munchkins: Droves of U.S. citizens

- Toto: Prohibitionists, who largely supported the free silver movement

- The Wicked Witch of the East: Factory owners in the East

This interpretation of the novel reveals some interesting hidden gems. The story follows a girl named Dorothy who’s lost her way and is far from home. What she’s really seeking is safety and security. At the encouragement of the munchkins, she follows the Yellow Brick Road (the gold standard) to Emerald City, which many believe represents Washington D.C.

Once there, she discovers that the great and powerful Oz is nothing more than a fraud. Interestingly, “oz” is the abbreviation used for an ounce of gold. In the end, it is Dorothy’s silver shoes (the film adaptation made them ruby) that save her.

Some theorize that Baum intended The Wizard of Oz to be a pro-populist allegory, and that he himself was a pro-silver populist, though it’s a theory about which historians have mixed feelings. Harry Littlefield, who was a high school teacher in the 1960s, was the first to link the story to the gold standard (and the politics and tension surrounding it). Baum did appear to have been sympathetic to populism and did in fact support William Jennings Bryan in the 1896 election.

Again, the story is open to interpretation — but the theory certainly makes sense given the economic and social tension present at the turn of the century. Is it a case of art imitating life? Some historians believe so. Other folks believe it’s nothing more than a coincidence.

Either way, Dorothy’s story still resonates today. As inflation hits record highs, the Federal Reserve has continued to raise interest rates in an attempt to cool things down. This increases the cost of borrowing money. It’s tempting to wonder how history would have panned out had the gold standard stayed in effect. We’ll never know, but over a century after its publication, The Wizard of Oz continues to tease our imagination.