As the world goes cashless, how are our spending habits changing?

- The form our money takes can have an outsized influence on the ways we spend it.

- Non-cash payments have nearly doubled since 2016, and are estimated to double again by 2024. The way we spend money is changing.

- Here are some strategies for smart spending in an increasingly cashless age.

In 1949, a businessman named Frank McNamara was dining at a New York City restaurant when he realized he had forgotten his wallet at home. The bill came. His wife covered for him. Embarrassed and resolved never to let it happen again, McNamara helped start the Diners Club — the world’s first payment card that became widely accepted by mainstream merchants. The Diners Club was the first step on the journey to a world where an estimated 2.8 billion credit cards are currently in use, roughly one-third of which are in the U.S.

Since 2016, global non-cash payments have increased by more than 60 percent. It’s estimated that a quarter of the world’s retail transactions will be conducted online by 2025, with very little physical money changing hands at all. We’re using contactless payments, mobile banking apps, and backstage direct debits for more and more things.

Still, it’s probably too early to eulogize the death of cash. After all, cashless habits massively vary from country to country, and even corporate behemoths like Amazon overestimate its uptake. But the data tell one clear tale: “Going cashless” is ingrained in how we spend.

So, how has this shift toward cashless transactions affected our spending habits? And how can we make smarter decisions in a cashless world?

Why we like cashless

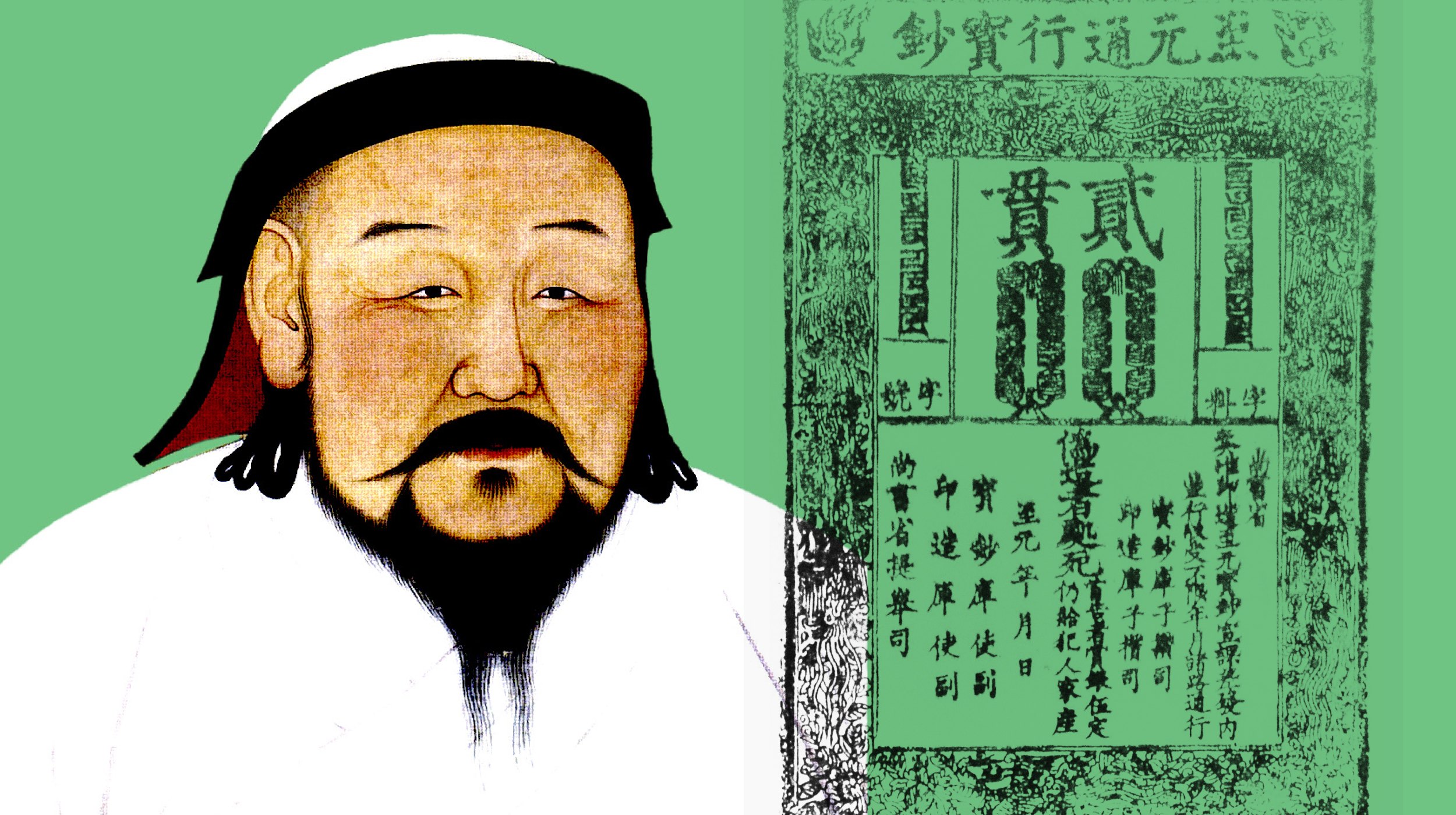

In many ways, the history of money is a history of convenience. One of the main purposes of money has always been to function as a medium of exchange: We can buy something, go somewhere, or help someone, all through a simple transfer of money from one party to another. So, if there are easier, faster, and smarter ways to do that, history shows that the financial world will evolve to adopt it. For example, coins are easier than bartering, notes are lighter than coins, cards are easier than notes, and apps are smarter than cards.

McNamara’s Diners Club became so internationally popular because it was sold on this very convenience. A cardboard card is lighter (and less prone to theft) than a thick, loaded wallet. But McNamara also saw something beyond convenience: Cashless cards had the power to change our spending habits. He sold his Diners Club card to businesses with the pitch that customers would spend more with the card than without it.

Was McNamara just spinning a marketer’s lie, or do cashless payments really affect how we spend?

The “cashless effect”

The reason that credit has such a long and important history is that it allows people, businesses, and even nations to spend what they otherwise do not have. (Some economic historians have even argued that Britain’s banking and credit sector was how the nation survived and outfought the French and Spanish empires in the 18th and 19th centuries).

Credit is a kind of loan. It can provide large sums of money quickly, to be paid back over time. While it wasn’t initially intended to encourage overspending, that’s certainly part of the appeal for creditors today. Recent data suggest that 40 percent of U.S. credit card owners carry a balance over month-to-month, and, collectively, Americans owe $841 billion in credit card debt. To put that in perspective, that’s roughly equivalent to the entire GDP of the Netherlands (which, by the way, was an early leading innovator and adopter of credit systems).

Going cashless encourages us to spend more than we would otherwise. This is known in behavioral economics as the “cashless effect” — the observation that we find it easier to part with money when it is intangible.

In 1996, Ofer Zellermayer described the idea of “pain of payment,” where the “pain” we feel using different methods of transaction will change depending on whether the transaction involves cash or not. Zellermayer noted that a “credit card [is] the preferred option for painful items,” not only because it’s out of sight and behind closed doors, but because it can “serve to make the payment feel more generic, and thus less painful.”

If we had to use only $5 bills at the gas station, filling up on gas would feel much more painful. If buying a smartphone involved the cashier counting out your money once, then twice, you’d cringe each time. As Prelec and Loewenstein from MIT put it, “The ticking of the taxi meter, for example, reduces one’s pleasure from the ride.”

One factor behind this effect is a psychological phenomenon called “coupling.” When we pay in cash — say, when we buy a burger from a street vendor — the act of paying and the item are closely coupled. The physical act of handing over money can reduce our enjoyment of the consumption. Conversely, as Hal Hershfield of New York University described, “It’s this lack of coupling that can make using the ‘download’ button on iTunes, shelling out tokens at casinos, or paying with credit cards seem painless.”

“Decoupling” is a trick long exploited by casinos and gaming companies. When gamblers use chips or tokens instead of cash, they are much more likely to gamble more. Research suggests it’s all to do with how “real” the brain treats these representations of money. As Lapuz and Griffiths described in a paper published in the journal Gambling Research, “the use of virtual representations of reaI money may heIp to remove the dislike or ‘pain’” of losing money.” The paper even goes on to say a “socially responsible” casino would do well to remove chips and bring back cash gambling. Few major casinos operating today do.

Smart spending in a cashless age

Given that “cashless is painless,” it’s no wonder that the average credit card payment is more than double the size of the average cash one. (Of course, it’s also hugely impractical to have to withdraw thousands of dollars for a car purchase, for example). The problem, though, is that sometimes spending needs to be painful. When the cashless world lures us in, it often leads to overspending. So, here are five quick, useful pieces of advice to spend smarter, not more.

Use cash. We’ve all encountered businesses that discourage or prohibit paying in cash. But these are still the minority (and more states every year are bringing in laws to ban “cashless only” stores). Try as much as you can to use cash for your everyday purchases like groceries or coffee. Having a fixed amount in hand, an amount you can’t go over, can help you spend less overall.

Set limits. With services like Apple and Google Pay, it’s almost too easy to spend money. I can’t be the only person to have found it a bit weird to spend half a month’s salary in one pleasant and dopamine-releasing “beep!” Both services, and most banks (if you call them up), will allow you to “self-set” a limit.

Make sure you can reclaim payments. Many cashless payment methods offer ways to reclaim money when problems occur with transactions. PayPal, for example, gives you six months to “raise a dispute” over a purchase. Similarly, if you’re a victim of fraud or “unauthorized transaction,” most banks, most of the time, will reimburse that money (something that won’t happen if you have cash stolen, for instance).

Check recurring subscriptions. It’s great not having to worry about paying your electricity bill or that streaming service you love. What’s not great is wasting money on a service you don’t use anymore. Most banking apps let you easily check your direct debits and standing orders. As for those “free trial period” sign ups? Set a reminder in your phone or on your computer to cancel three days before it’s due.

Automate your savings goals. Just as technology has made it easier to overspend, it has also enabled more ways to automate healthy personal finance habits. For example, smartphone apps can automatically help you track your expenses, set a budget, and save for the future. One way to avoid overspending is to prioritize savings goals. Consider setting weekly or monthly savings goals that you need to hit before going online shopping for stuff you might not need. That way you can occasionally splurge while still knowing you’re on track toward financial security.

The future is almost certainly going to be cashless, but that doesn’t mean it has to be a debtors’ world. As with all emerging technologies, it pays to be aware of how innovations in money can not only make our lives easier, but also create new types of financial pitfalls to avoid.